Engagement & Retention project | Myntra

Why have I chosen Myntra for my project?

I run a D2C clothing brand, I chose Myntra for my project because of my keen interest in fashion companies and their creative methods of attracting and keeping customers.

After completing my Myntra Onboarding Assignment, I got to know about their effective techniques, which precisely matched my objectives for my D2C clothing brand, Alaya.

I want to follow Myntra's lead in the fashion e-commerce space as it offers a useful blueprint for expansion and client retention.

🌊 Let’s deep dive : MYNTRA

Myntra is everyone’s go-to place for all fashion and lifestyle needs. As India's biggest online store for fashion and lifestyle products, Myntra aims to make shopping easy, fun and hassle-free for people all over the country. Myntra offers a huge variety of brands and products.

We do not need to wait for the weekend to dress up, visit malls, carry heavy shopping bags for hours, worry about parking and the weather, stand in long billing queues because Myntra is solving it all for you.

Myntra has India’s largest catalogue of fashion and lifestyle products ranging from clothes to accessories to home furnishings.

Myntra has partnered with over 5000+ leading fashion and lifestyle brands in the country such as Nike, Adidas, Puma, Levis, Wrangler, Arrow, Jealous 21, Diesel, CAT, Harley Davidson, Ferrari, Timberland, US Polo, FabIndia, Biba, and many more, to offer a wide range in latest branded fashion and lifestyle wear.

⚖️ Competitive Comparison :

Myntra got 58.66 million visits in May 2024. 83.36% visits were made through Mobile and 16.64% visits were made through Desktop.

On myntra.com, visitors mainly come from Direct (60.2% of traffic), followed by google.com (24.64%). In most cases, after visiting myntra.com, users go to payu.in and juspay.in.

Myntra.com’s traffic has increased by 12.0% month-on-month up to current organic search traffic. In addition, paid search traffic has increased by 114.21% up to current paid search traffic.

Myntra:

Ajio:

Meesho:

Tata Cliq:

🛹 List of Myntra competitors in May 2024:

ajio.com , with 27.72M visits, 81 authority score, 59.08% bounce rate

meesho.com , with 31.62M visits, 75 authority score, 49.24% bounce rate

tatacliq.com , with 8.83M visits, 66 authority score, 62.31% bounce rate

etsy.com , with 385.44M visits, 100 authority score, 45.18% bounce rate

nykaa.com , with 12.57M visits, 76 authority score, 61.39% bounce rate

flipkart.com , with 251.34M visits, 97 authority score, 54.32% bounce rate

hm.com , with 94.57M visits, 92 authority score, 44.54% bounce rate

📌 Source - https://www.semrush.com/website/myntra.com/competitors/

In financial year 2023, Myntra reported an operating revenue of 43.75 billion Indian rupees. This was an increase as compared to the previous year. Myntra is the largest fashion e-commerce platform in India

📌 Source - https://www.statista.com/statistics/1350271/myntra-operating-revenue/#:~:text=In financial year 2023%2C Myntra, compared to the previous year.

🎳 Core Value Proposition:

🏆 India’s No.1 Online Fashion Shopping Destinations.

🛍️ Serving customers from the largest collections of fashion and lifestyle brands.

🚚 Equipping them with the convenience of doorstep delivery without stepping out of their home.

👀 Real-Time tracking of delivery

🤑 Super-fast delivery, 100% authentic products, and multiple payment options (Cash on Delivery and EMI facility)

👏 Easy exchanges and hassle-free returns.

💸Most attractive discounts and the best deals available on the largest collection of brands

💻 user-friendly interface and search option like photo search, vernacular search and fashion chat GPT make it easy for customers to find the products.

📍Serves to more than 19,000 pin codes in the country.(ref.source)

👭Value add services like personalised styling provides personalised recommendations to the customers based on their previous purchases and a try on feature on product page gives the customer a feel of how the product will look on them.

How do the users experience it repeatedly?

Existing User:

- Push Notifications

- Recommendations based on previous purchases.

- Clear visuals/text of CVP mentioned on each page on website.

- Consuming content on social media channels.

- Emails about latest offers, events and sale.

New User :

- Free deliveries and easy return policy.

- Consuming content on social media channels and then making a purchase.

- Searches on Google showcasing Myntra offers fashion, accessories , home at a great price.

Natural Frequency of Users:

- Casual users: 1-2 times a year

Casual Myntra users usually shops form offline markets. They only shop from Myntra in exceptional cases. They do value options like free delivery, easy return and exchange.

- Core users: 3-4 times a year

Core Myntra users usually 3-4 times a year however they do shop from other competitors as well. They prefer to order quality product and do price check before ordering. They seek good customer support.

- Power users: Once in 1-2 months

The power Myntra users order once or twice in every month. They seek to purchase high quality products. They purchase on Myntra recommendations about brands.

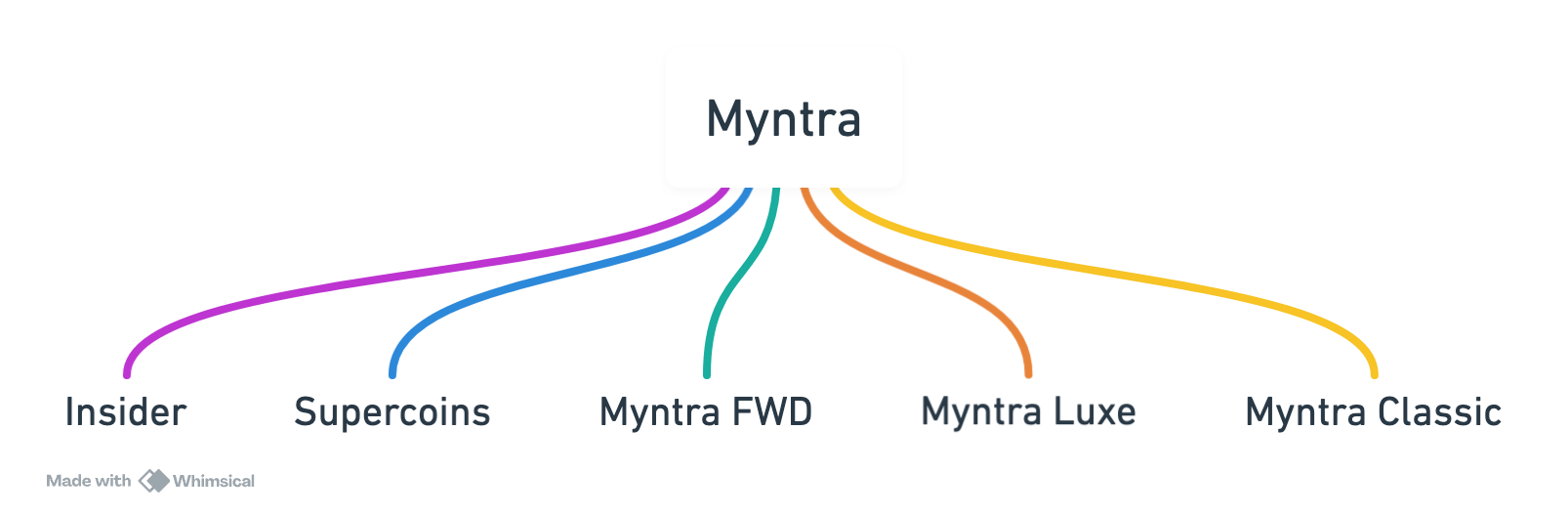

Sub Products of Myntra :

Sub-Product | Age Range | JTBD | Casual User | Core User | Power User |

|---|---|---|---|---|---|

Myntra FWD | 18-32 | Access to the latest trends, fresh designs, and complete look suggestions | 1-2 times in a year | 4-5 times in a year | 1-2 times in every month |

Myntra Classic/Everyday | 20-55 | Excellent deals, regular sales, budget-friendly options, wide variety | 1-2 times in a quarter | Once in every month | Once in every week |

Myntra Luxe | 25-55 | Access to luxury brands, hassle-free return/exchange, convenient purchasing, attractive deals, wide selection | Once a year | Twice or Thrice a year | Once in quarter |

Insider | 18-35 | Early access to sales, free shipping on all purchases, express delivery, additional discounts, free fashion advice from a personal stylist, priority customer support | 1-2 Times a year | 2-3 Times a year | 2-3 times in a month |

Supercoins | 18-45 | User-friendly payment method, encourages customers to spend more | once a year | Twice/Thrice a year | once /twice in every month |

Natural Frequency of sub products is completely related to the natural frequency of buying from Myntra as all these sub products can be used on the similar frequency of purchase.

UNDERSTANDING RFM FRAMEWORK FOR MYNTRA :

The RFM framework (Recency, Frequency, Monetary) is an ideal choice. This framework helps identify and categorise customers based on their purchasing behaviour, allowing Myntra to tailor its E&R strategies effectively.

1.Recency:

Measures how recently a customer made a purchase.

- Metric: Days since last purchase.

- Reasoning: Customers who have purchased recently are more likely to engage again. Focusing on recent purchasers can help boost retention rates.

2. Frequency:

Measures how often a customer makes a purchase within a given time period.

- Metric: Number of purchases a user makes in a month.

- Reasoning: Frequent purchases indicate strong engagement and loyalty. By tracking frequency, Myntra can identify core customers who are consistently active and tailor rewards and promotions to encourage continued engagement.

3. Monetary:

Measures the total spending of a customer over a specific period.

- Metric: Total spend per user in a month or average order value.

- Reasoning: High spenders are valuable customers. Understanding their purchasing behavior allows Myntra to offer personalised recommendations and exclusive deals to maximize their lifetime value.

Integrating with Frequency, Breadth and Depth Metrics

- Frequency:

- Metric: Number of purchases and visits per month.

- Reasoning: High frequency indicates strong engagement and loyalty. Encouraging frequent interactions helps retain customers and increases their lifetime value.

- Depth:

- Metric: Average order value, number of items in wishlist, number of pages visited.

- Reasoning: Higher depth indicates users are spending more time and money per session, enhancing overall engagement.

- Breadth:

- Metric: Number of sub-products/categories experienced, visits to Myntra Insider/Studio/supercoins.

- Reasoning: Broader engagement across different features and categories indicates a well-rounded user experience and helps identify cross-selling opportunities

Based on the above framework, we have selected frequency of depth of engagement to optimise for all the engagement frameworks.

Frequency = X times in Y time = 1 order/ week irrespective of the transaction value which will led the user to build a habit.

There are several reasons for this:

- Indicator of Engagement:Frequency directly measures how often customers interact with Myntra, whether through purchases or visits. High frequency indicates strong customer engagement and a high level of brand interaction.

- Customer Loyalty:Frequent purchases and visits suggest that customers are satisfied with their experiences and trust the brand. Increasing frequency helps build customer loyalty, moving users from casual to core to power.

- Revenue Growth:Encouraging frequent purchases increases overall sales volume and revenue. Frequent interactions will provide more opportunities for cross-selling and upselling, boosting the average order value and total spend.

- Retention:Customers who engage frequently are less likely to churn. By focusing on frequency, Myntra can develop targeted strategies to keep customers coming back, such as loyalty programs, personalised offers, and regular engagement campaigns.

- Behavioural Insights:Tracking frequency provides valuable insights into customer behaviour and preferences. This data can be used to tailor marketing strategies, improve product recommendations, and enhance the overall shopping experience.

(By prioritising frequency, Myntra can ensure that its customers remain engaged and loyal, leading to sustained revenue growth and a competitive edge in the fashion e-commerce market.)

🚴🏻♀️ Defining Active User and Key Metrics for Myntra :

Active User Definition:

An active user on Myntra is someone who signs up, makes a purchase without initiating a return, and repeats this purchase at least once every 6 months. This timeframe aligns with typical seasonal shopping behaviours observed among users.(User call insight)

Rationale:

- Engagement Criteria: Signing up and making a non-returnable purchase demonstrates initial engagement and ongoing interest in Myntra's offerings.

- Purchase Frequency: Requiring a repeat purchase every 6 months ensures consistent engagement and participation in the platform's activities.

- Seasonal Shopping Behaviour: The 6-month timeframe corresponds with observed patterns where users tend to shop for fashion apparel seasonally, validating the chosen period.

There are other key metrics for Active Users:

- Monthly App Visits:

- Metric: Users who visit the Myntra app or website at least once a month.

- Reasoning: Regular visits demonstrate continuous interest and engagement with the platform, reflecting active user participation.

- Order Placement in the Last 6 Months:

- Metric: Users who have placed at least one order in the last 6 months, with no returns initiated within the 14-day return window.

- Reasoning: This metric indicates active purchasing behavior and satisfaction with products received, essential for measuring user retention and lifetime value.

- Sales Participation:

- Metric: Number of users who make purchases during sales events (e.g., seasonal sales, festive sales).

- Reasoning: Participation in sales events shows responsiveness to promotions and price incentives, highlighting user engagement with Myntra's promotional strategies.

- Average User Session Time:

- Metric: Average time (in minutes) users spend per session browsing on Myntra.

- Reasoning: Longer session times indicate deeper engagement and interest in products, contributing to higher chances of making a purchase.

- Myntra Insider Engagement:

- Metric: Number of users actively using Myntra Insider features (e.g., redeeming SuperCoins, accessing exclusive offers).

- Reasoning: Engagement with Myntra Insider reflects loyalty and commitment to the platform, influencing repeat purchases and higher customer retention.

- SuperCoins Redemption:

- Metric: Users who utilise Myntra Insider offers by redeeming SuperCoins for discounts or rewards.

- Reasoning: Redeeming SuperCoins shows active participation in loyalty programs, incentivising continued purchases and increasing customer lifetime value.

- Saved Payment Methods:

- Metric: Users who save their payment details for seamless checkout.

- Reasoning: Saving payment methods simplifies the purchase process, indicating trust and convenience in using Myntra for shopping.

- Wishlist Activity:

- Metric: Number of users who create and maintain wishlist on Myntra.

- Reasoning: Wishlist reflect intent to purchase and interest in specific products, providing opportunities for targeted marketing and personalised recommendations.

- Cart Additions:

- Metric: Users who add items to their shopping cart.

- Reasoning: Adding items to the cart signifies strong purchase intent, requiring strategies to convert abandoned carts into completed purchases through timely incentives or reminders.

Natural Frequency:

- Casual Users: 1-3 Orders per year

(Usually users that have not explored the breadth of the Myntra)

- Core Users: 4*-6 Orders per year*

Usually users that are loyal to a particular category(fwd/luxe/etc.) and have a recurring behaviour to buy that.

- Power Users: 8+ orders per year

Usually loyalists of the brand, who have explored almost and use Myntra for all their shopping needs.

User Segmentation Framework 👥

A. Power/Core/Casual Segmentation:

Segmentation | Description | Natural Frequency | Key Features Used | Categories |

|---|---|---|---|---|

| Power Users | Regular shoppers making frequent purchases (1-2 times/month) | 1-2 times/month | Myntra Insider, Supercoins, | Clothing, Beauty, Home, Accessories, Footwear |

| Core Users | Consistent shoppers buying 2-4 times in 3-6 months. Focus on clothing, occasional use of Myntra Studio, Insider. | 2-4 times/3 months | Myntra Insider, Myntra Everyday | Clothing, Accessories |

| Casual Users | Infrequent shoppers making 2-4 purchases in 9-12 months. | 2-4 times/6-9 months | No feature exploration. | Clothing |

B. ICP/Persona Segmentation:

| Category | Tanya - ICP 1 | Arpit - ICP 2 | Roopam - ICP 3 |

|---|---|---|---|

Demographic Information | Age: 27 | Age: 26 | Age-32 |

Occupation: Corporate Professional | Occupation: Marketer | Occupation: Fashion Influencer/Creator | |

City: Gurugram | City: Bangalore | City: Gurugram | |

Digital Habits | Most Used Apps: Instagram, YouTube, Hotstar, Netflix, Spotify | Most Used Apps: Instagram, Reddit, LinkedIn, YouTube | Most Used Apps: Instagram, Facebook, Hotstar, Netflix, Spotify, Reddit, Canva, Inshorts |

Shopping Apps: Myntra, Ajio, Urbanic, Mulmul | Shopping Apps: Myntra, Amazon | Shopping Apps: Myntra, Nykaa, Amazon, Ajio, Etsy | |

Shopping Behaviour | Monthly Spend: ₹8000-9000 | Monthly Spend: ₹4000-4500 | Monthly Spend: ₹5000-10000 |

Payment Method: UPI, Credit Card | Payment Method: Credit Card | Payment Method: COD, Credit Card, UPI | |

Usage Specifics | Reasons for Using Myntra: Variety, multiple size options, unique & trendy styles | Reasons for Using Myntra: Men's apparel, fitness watches | Reasons for Using Myntra: A member of Myntra Insider, follow trend videos there and works for Myntra on IG |

Preferences: Easy returns, quality products | Preferences: Discounts, trusted brands | Preferences: New Designs, Trendy Silhouettes and Brands | |

| Money vs Time | Money | Money | Time |

Type of content consumed | Entertaining + educational short-form content. | Long-form content (typically 8-10 mins long), focused on educational content. | Entertainment-led short-form + long-form content, reels most of the time. |

Commonly used shopping apps | Blinkit, BigBasket, Amazon | Amazon, BlinkIT, Zepto | BlinkIT, Zepto, |

Weekend Routine | Wake up at 9, go for a walk, breakfast, spend time with family and watching content on OTT networks. Swap OTT & family time and meal schedules in case a dinner is planned instead of lunch/brunch. Both days look more or less similar in terms of the schedule | Wake up at 7 am, have breakfast with. Go to market for a quick grocery run. Come back and take a short nap. Evenings followed by dinner are usually spent with friends. | Wake up at 8 am, have have a leisurely breakfast, spend time reading/watching OTT content. Head out to meet some creators or for shooting some content.come back home and have dinner and sleep. |

| Engagement Questions | | ||

How often do you typically shop for clothing? | I usually shop for clothing once a month. | I typically shop for clothing once every two months. | I shop for clothing multiple times a month. |

What are the key factors you consider when shopping for clothes? | I look for variety, multiple size options, unique and trendy styles, and easy returns. | I look for discounts, trusted brands, and men's apparel. | I look for new designs, trendy silhouettes, and popular brands. |

Where do you usually purchase clothes from? | I usually purchase clothes from Myntra, Ajio, Urbanic, and Mulmul. | I usually purchase clothes from Myntra and Amazon. | I usually purchase clothes from Myntra, Nykaa, Amazon, Ajio, and Etsy. |

Why do you prefer shopping on Myntra over other platforms? | I prefer Myntra because of the variety, multiple size options, and trendy styles it offers. | I prefer Myntra for its wide range of men's apparel and fitness watches. | I prefer Myntra because I am a Myntra Insider, I follow trend videos, and I work for Myntra on Instagram. |

Which features or aspects of Myntra do you find most valuable or appealing? | The easy returns and quality products are the most valuable features for me. | The discounts and trusted brands are the most valuable aspects for me. | The trendy designs, new collections, and insider benefits are the most valuable aspects for me. |

How satisfied are you with your overall shopping experience on Myntra? | I am quite satisfied with my overall shopping experience on Myntra. | I am quite satisfied with my overall shopping experience on Myntra. | I am very satisfied with my overall shopping experience on Myntra. |

Do you actively participate in Myntra's promotions, sales, or loyalty programs? | Yes, I actively participate in Myntra's promotions, sales, and loyalty programs. | Yes, I actively participate in Myntra's promotions and sales. | Yes, I actively participate in Myntra's promotions, sales, and loyalty programs. |

| Retention Questions | |||

Which feature or service of Myntra do you find least valuable or least used? | I find the recommendations based on past purchases least valuable as they often do not match my current preferences. | I find the beauty and personal care section least valuable as I rarely shop for these products. | I find the limited options in high-end fashion least valuable as I prefer more variety in this segment. |

What would make you consider switching to another platform instead of continuing to shop on Myntra? | Poor customer service or a decline in the quality of products would make me consider switching to another platform. | Limited availability of desired products or better discounts on other platforms would make me consider switching. | Lack of new and trendy collections or better insider benefits on another platform would make me consider switching. |

How likely are you to continue shopping on Myntra in the future? | I am very likely to continue shopping on Myntra in the future. | I am likely to continue shopping on Myntra in the future. | I am highly likely to continue shopping on Myntra in the future. |

What improvements or changes would you like to see on Myntra to enhance your shopping experience? | I would like to see more detailed product descriptions and better recommendations based on my shopping history. | I would like to see more frequent sales and better deals on men's apparel. | I would like to see more collaborations with popular designers and expanded options in high-end fashion. |

What are your expectations from Myntra to keep you as a loyal customer? | Consistent quality, regular updates with trendy styles, and maintaining the easy returns policy are my expectations to remain a loyal customer. | Continued discounts, availability of trusted brands, and good customer service are my expectations to remain a loyal customer. | Regular updates with trendy collections, exclusive insider benefits, and collaborations with popular designers are my expectations to remain a loyal customer. |

What other apps do you use for shopping clothes? | I also use Ajio, Urbanic, and Mulmul for shopping clothes. | I also use Amazon for shopping clothes. | I also use Nykaa, Amazon, Ajio, and Etsy for shopping clothes. |

Core/Casual/Power | Core | Casual | Power |

C. Products/Feature Used Segmentation:

Segmentation | Description | Natural Frequency | Key Features Used |

|---|---|---|---|

Feature Explorers | Actively engage with Myntra Insider, Studio for style advice, occasional Live participation. | Moderate | Myntra Insider, Studio, Live sessions, Supercoins |

Comprehensive Users | Utilise all features extensively - Myntra Insider, Studio, Beauty, Live. High engagement and frequent purchases. | Frequent | Myntra Insider, Studio, Beauty, Live Sessions |

Basic Users | Primarily purchase clothing, occasional footwear, minimal use of additional features. | Infrequent | Basic clothing |

D. Revenue Generated Segmentation:

Segmentation | Description | Revenue Contribution | Average Order Value (AOV) | Lifetime Value (LTV) | Engagement Level |

|---|---|---|---|---|---|

High Rollers (Power) | Top revenue generators, frequent high-value purchases, extensive use of premium features. | High | High | High | High Engagement |

Moderate Spenders (Core) | Regular revenue contributors with moderate spending patterns, occasional use of additional features. | Moderate | Moderate | Moderate | Medium Engagement |

Budget Shoppers (Casual) | Low revenue contributors, minimal spending on basic clothing needs, infrequent feature usage. | Low | Low | Low | Low Engagement |

E. Advanced Segmentation:

Segmentation | Description | Recency (Time since the last purchase) | Frequency Per Month (Average number of orders per month) | Key action Score (Score based on the number of key actions like orders, returns, feature engagement) | No. of other use cases used (Number of other Myntra features used in the last month) |

|---|---|---|---|---|---|

Loyalists | Regularly orders (frequency <1 month), high engagement across all features, shares wishlist. | <1 month | 2-4 | 4+ | 2+ |

Champions | High-frequency buyers with comprehensive feature usage (Insider, Studio, Beauty, Live), early access users. | <1 month | 2-4 | 6+ | 2+ |

Need Attention | Placed bulk orders but returned significant portions, items in wishlist are getting sold out, volume of purchases has decreased. | >3 months | 1-3 | 2+ | 1 |

In Danger | Reduced order volume, occasional returns, basic feature usage, declining engagement. | >1 month | 0-3 | 1+ | 1 |

Hibernating | No recent purchases, minimal or no engagement with features, potentially dormant users. | >3 months | 0-1 | 0-1 | 0 |

Product Hooks:

The following are three recommended product hooks that will help us crack engagement and retention campaigns for Myntra users:

🪝 Product Hook 1: Myntra Style Insider Subscription

Goal:

Encourage core users to purchase more products and increase their purchase frequency while providing them with value and convenience.

Problem Statement:

Core users often have varying needs for fashion and lifestyle products and might not remember to explore new collections or reorder, resulting in gaps between purchases.

Current Alternative:

- Core users make individual, one-time purchases based on their needs, leading to potential delays in exploring new collections and missing out on timely deals.

- Users opt for ad-hoc browsing and shopping during sales events.

Solution: The Style Insider Subscription

- Exclusive Discounts: Subscribers enjoy exclusive discounts on monthly subscriptions, making our products more budget-friendly.

- Personalised Fashion Boxes: Tailored fashion boxes curated by stylists based on user preferences and trends.

- Early Access: Subscribers get early access to new collections and sales events.

- Flexible Customisation: Users can tailor their subscription with a combination of clothing, accessories, and beauty products.

- Style Points: Subscribers earn extra style points for every purchase, which can be redeemed for additional discounts and perks.

User Flow:

Success Metrics:

- Increase in monthly order frequency among core users.

- Growth in the average order value (AOV) for Style Insider subscribers.

- Reduction in churn rate among core users.

- Positive user feedback and satisfaction.

Other Metrics to Track:

- Subscriber retention rate.

- Average subscription duration.

- Conversion rate of core users to Style Insider subscribers.

- Customer feedback on subscription experience.

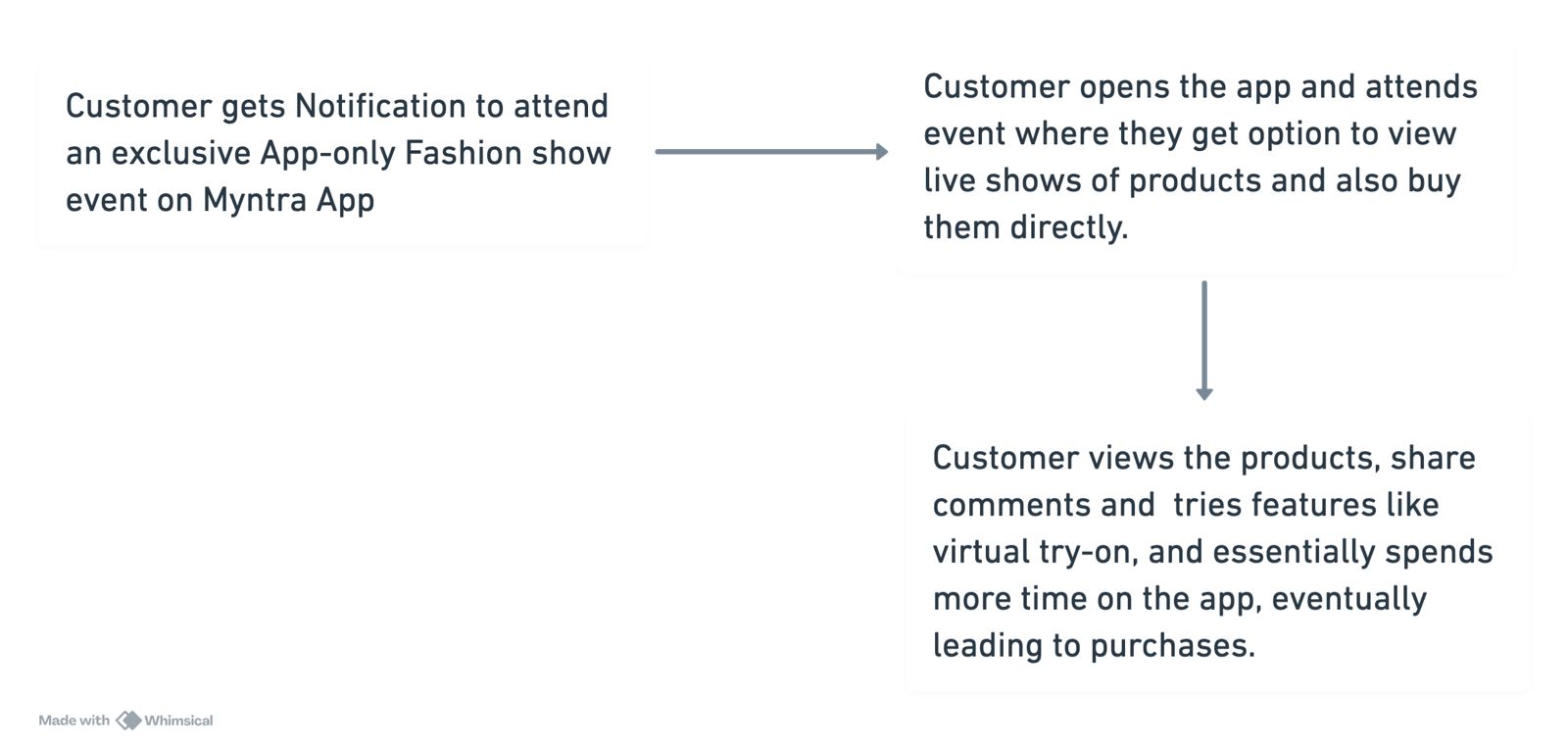

🪝 Product Hook 2: Interactive Fashion Events

Goal:

Boost user engagement and session duration by providing interactive and immersive fashion experiences.

Problem Statement:

Users tend to have short session durations and low interaction rates with additional app features beyond shopping.

Current Alternative:

- Standard shopping apps with minimal interactive elements.

- Limited engagement with additional features like fashion tips and live events.

Solution: Interactive Fashion Events

- Live Fashion Shows: Users can join live fashion shows hosted by designers and influencers.

- Virtual Try-On: Augmented reality (AR) feature that allows users to virtually try on clothes and accessories.

- Fashion Quizzes and Challenges: Engaging quizzes and challenges where users can win discounts and prizes.

- Interactive Polls: Real-time polls during live events to involve users in fashion decisions.

User Flow:

Success Metrics:

- Increase in average session duration.

- Higher participation rates in live events.

- Growth in user interaction with virtual try-on features.

- Positive user feedback and satisfaction.

Other Metrics to Track:

- Number of users attending live events.

- Engagement rate with interactive features.

- Conversion rate of event participants to purchasers.

- Customer feedback on interactive experiences.

🪝 Product Hook 3: Myntra Loyalty Program

Goal:

Boost customer retention by rewarding loyal users with exclusive benefits and creating a sense of community.

Problem Statement:

Many users do not feel adequately rewarded for their loyalty, leading to decreased engagement and higher churn rates.

Current Alternative:

- Basic loyalty programs with limited rewards.

- Standard discount codes and seasonal sales.

Solution: The Fashion Loyalty Program

- Tiered Membership: Users start at a basic tier and can progress to higher tiers (Silver, Gold, Platinum) based on their activity.

- Points System: Users earn points for every purchase, review, and referral.

- Exclusive Benefits: Higher tiers offer perks like free shipping, priority customer support, and invitations to VIP events.

- Community Features: A dedicated space for loyal customers to share their fashion looks, participate in exclusive forums, and get personalised style advice.

User Flow:

Success Metrics:

- Increase in repeat purchases.

- Growth in the number of users progressing through loyalty tiers.

- Higher engagement in community features.

- Positive user feedback and satisfaction.

Other Metrics to Track:

- Number of users in each loyalty tier.

- Redemption rate of loyalty points.

- Conversion rate of regular users to loyal program participants.

- Customer feedback on the loyalty program experience.

🗣️ Engagement Campaigns:

User Type | Casual User | Casual User | Core User | Power User | Power User |

|---|---|---|---|---|---|

Segment | Hibernating | In- danger | Needs Attention | Loyalist | Champions |

Goal | Reduce the time between purchases from 1-2 times a year to 4 times a year | To revive at-risk user and save from churning. | Increase AOV | Cross-selling from Other Categories to users who only buy clothes from Myntra | Feedback campaigns. |

Campaign ideas | Trigger an email/WA to users who haven’t placed an order in last 3 Months | Limited period exclusive gift card of Rs 500 in collaboration with New brands on the platform | Exclusive Discounts based on no. of items | Special Discount on Buying A Man’s Perfume with any T-shirt. | Ask for Product and feature recommendations, and testing Beta features from Champion users |

Campaign Creative Idea | Banner should focus on Season’s Best seller with the offer highlighted | Gift Voucher and eligible brands. “No Conditions Applied” | Product pic from wishlist or similar category, Price after discount | New category Best Seller, along with the Offer | AI Try-on testing exclusively for Power users. |

Channel | Whatsapp, Paid Ads, Push Notification, E-mail | SMS, Email, Whatsapp | Instagram Ads, WhatsApp | WhatsApp & Push Notification | WhatsApp, Push Notifications |

Pitch | Get 10% Cashback and up to 50% off on New Styles. | Exclusive Gift Card of Rs 500 on SuperDry Bags | Buy 1 Get 20% Off, Buy 2 Get 30% Off, Buy 3 Get 40% Off | Get Titan Skn Perfume at just Rs. 299 on Purchase of any T-shirt | Try out our new AI Try-on launched for limited users. Share your feedback with our tech team |

Success Metric | Percentage of users making a purchase | No of users saved from Churning | % Increase in AOV | Increase in LTV of Power Users | Number of feedbacks received |

Additional Metrics to Track | Open rates, CTR | Order Value, Average Discount Percentage (Cost of Discount) | Sales revenue, Average Discount Percentage | Revenue increase in other categories | Character count of each feedback, Quality score of feedback. |

📢 RETENTION :

Bird's-eye view: Myntra

What is your current retention rate in terms of users?

- A realistic customer retention rate is between 30%-40% for an E-commerce business.

- Myntra has 60 million Monthly active users and 100 million+ total registered users. Retention rate for Myntra = 60/100 = 60% (approximately)

-

At what time period does your retention curve flatten? Draw the retention curve.

According to available data, Myntra's customer retention rate varies based on different time periods and segments. As of recent insights, Myntra has reported varying retention rates across different cohorts and segments:

- Day 2 (D2): ~55%

- Day 7 (D7): ~45%

- Day 30 (D30): ~40%

- Day 90 (D90): ~35%

- Month 6 (M6): ~34%

- Month 12 (M12): ~33%

Retention Curve and Flattening Period?

Myntra initially sees high user engagement when customers start using the platform for fashion shopping.

However, competition from Ajio, Amazon, and other factors like Myntra's acquisition by Flipkart and the Covid-19 pandemic have affected retention rates.

Currently, Myntra's retention curve is most likely to stabilise around 8 weeks after users begin engaging with the platform.

Fashion and lifestyle products on Myntra are durable and less frequently purchased, so long-term retention is typically measured quarterly or annually to gauge ongoing user loyalty.

Which ICPs drive the Best Retention?

Both core and power users contribute significantly to Myntra's retention metrics, each driven by different motivations related to product stickiness and brand loyalty.

Core Users :

Characteristics:

- Consistent frequency (once/twice a month)

- High AOV (> Rs. 500)

- Avg. monthly spend of ~Rs. 1500

Behaviour:

- Very loyal to specific products

- Likely to keep buying preferred products

Retention Reason:

- High retention due to product stickiness

Power Users :

Characteristics:

- Extremely high frequency (once/twice a week)

- Reasonable AOV (between Rs. 300-500)

- Avg. monthly spend of ~Rs. 2500

Behavior:

- Loyal to the brand as a whole

- Willing to try new products and variants

Retention Reason:

- High retention due to brand loyalty and exploration

Which Channel drive users to Retain?

Channel | Description & Strategy |

|---|---|

Push Notifications | Preferred Communication : Most favoured red by users for its immediacy and relevance. Sending personalised notifications with tailored offers can significantly boost user engagement and retention. Push notifications are known to increase app launches by 88% and improve retention rates by 2-3x. |

| Direct Interaction : Second most preferred channel, ideal for personalised messages and interactions. Implementing a WhatsApp bot to gamify interactions can enhance engagement further, making it interactive and user-friendly. | |

| Detailed Communication : Effective for in-depth updates and announcements such as new loyalty programs or sale instructions. Frequency is key, with a weekly newsletter format ensuring engagement without overwhelming users. | |

Social Platforms (e.g., Instagram) | Audience Expansion and Re-engagement : Utilising social media for reaching new audiences and re-engaging churned users. Influencer collaborations and paid ads can amplify brand presence and effectiveness in driving retention. |

Which features/sub features drive the best retention?

Channel | Description & Strategy |

|---|---|

Personalised Recommendations | AI-driven Suggestions: Tailored product recommendations based on user preferences and browsing history. Personalisation enhances user experience and increases likelihood of repeat visits and purchases. |

Wishlist | Save for Later: Allows users to bookmark items they're interested in but not ready to purchase immediately. Helps retain intent and encourages return visits to complete purchases. |

Exclusive Discounts | Promotional Offers: Special discounts and offers for loyal customers or on high-demand products drive repeat purchases and increase overall transaction frequency. |

Fashion GPT (In-App Messaging/Chat) | Customer Support: Instant assistance for queries and issues via chat or messaging ensures seamless user experience, resolving concerns promptly and enhancing satisfaction. |

🧩CHURN :

Churned users for Myntra are those who were previously active customers, having placed orders in the past, but have not engaged or made a purchase for a prolonged period, specifically defined as 15-18 months.

This timeframe aligns with the assumption that a casual user places orders once a year on average.

Voluntary | Involuntary |

|---|---|

Collection/Styles Issue | Location Unserviceable |

Price Issues | Death / Major illness |

Quality Issues | Inability to buy |

Delayed delivery | Payment failures |

Cluttered UI/UX | Decided to save more |

Concerns about authenticity | Required brand not available |

Bugs and App crashes | |

Unaware of most of the features | |

Exchange/Refund related issue | |

Support Issue | |

Better discounts on other platforms | |

Negative reviews | |

❌Negative actions :

- Muting push/WhatsApp notifications: Users mute notifications indicating lost interest in offers and campaigns.

- App uninstalled: Users no longer need Myntra’s service or prefer other platforms.

- Abandoning carts: Users add items to cart but abandon them, possibly due to price comparison or indecision.

- High session time with no purchase or low AOV: Users spend time browsing but do not make purchases or have low average order values.

- Reduced frequency of app usage: Users visit less frequently, potentially shopping elsewhere or offline.

- Decrease in session time per visit: Users spend less time due to dissatisfaction with collection or price sensitivity.

- Negative reviews on social media: Users express dissatisfaction with products or services, impacting brand reputation.

- Increase in support tickets: Higher complaints indicate dissatisfaction with Myntra’s products or services.

- Low NPS, CSAT score: Low scores suggest unhappiness with products, impacting retention.

- High product returns: Increased returns signal dissatisfaction with product quality or fit, leading to potential churn.

⏳Retention Campaigns :

| Target Segment | Goal | Pitch/Content | Channel | Offer | Frequency & Time | Success Metric | Additional Metrics | Why? |

|---|---|---|---|---|---|---|---|---|

Muted Notification User | To get user to turn on the allow notification feature | Subject: "Don’t Miss Out on the Fun! 🎉" Hey [User’s Name], We noticed you’ve hit snooze on our notifications. 😴 But wait! By turning them back on, you’ll get: - Flash sales 🚀 - New arrivals 🌟 - Personalized picks just for you 💖 Ready to join the party? Tap below and stay in the loop! [Turn On Notifications Button] Cheers, Team Myntra | In app banners. Emails | Incentive: 10% off your next purchase when you turn on notifications. Additional Perks: Early access to sales and exclusive deals. | Frequency: One-time campaign with a follow-up reminder. Timing: Initial Email: Day 0 Follow-up Email: Day 7 | Percentage of users who turn on notifications. | Open Rate: Percentage of users who open the email. CTR: Percentage of users who click the "Turn On Notifications" button. Conversion Rate: Percentage of users who make a purchase using the discount after turning on notifications. | Personalized offers create a sense of exclusivity and urgency, enticing users to re-enable notifications for more updates. |

Users who are unable to find the preferred design/style | Attract them towards styles that are newly added | Subject: "New Styles Just Dropped! Find Your Perfect Match 🌟" Hey [User’s Name], We heard you! 🎧 Fresh designs and styles have just landed, and we think you’ll love them. Whether you’re into chic, trendy, or classic, we’ve got something new just for you! Check out our latest collection and discover your new favorites. 🌟 [Explore New Styles Button] Happy Shopping! Team Myntra | Mail, Push notification and WhatsApp | Incentive: Free shipping on your next order. Additional Perks: Personalized style recommendations based on past purchases. | Frequency: One-time campaign with a follow-up reminder. Timing: Initial Email: Day 0 Follow-up Email: Day 5 | Click-through rate on the "Explore New Styles" button. | Open Rate: Percentage of users who open the email. Engagement Rate: Time spent browsing new styles after clicking through. Conversion Rate: Percentage of users who make a purchase from the new styles. | Fresh and relevant product suggestions reduce friction by catering directly to user preferences, making it easier to find desired items. |

Users with product/quality Issues | Get users to give another chance and shop | Subject: "We’re Sorry! Here’s a Special Offer to Make It Right 💖" Hey [User’s Name], We’re sorry to hear about your recent experience with us. Your satisfaction is our top priority, and we want to make things right. As a token of our appreciation for giving us another chance, we’re offering you an exclusive discount on your next purchase. Discover our latest collections and find something you'll love. 🌟 [Shop Now Button] Thank you for being a valued Myntra customer. Warm regards, Team Myntra | Mail, Instagram paid ads, Push notifications | Incentive: 20% off on your next purchase. Additional Perks: Extended return policy for the next purchase | Frequency: One-time campaign with a follow-up reminder. Timing: Initial Email: Day 0 Follow-up Email: Day 7 | Redemption rate of the discount offer. | Open Rate: Percentage of users who open the email. Engagement Rate: Click-through rate on the "Shop Now" button. Conversion Rate: Percentage of users who complete a purchase using the discount. | Addressing past issues directly and offering a discount encourages users to give Myntra another chance with minimal risk. |

User who has had bad experience with delivery | Attract users to Myntra Insider with Express Delivery | Subject: "Smooth Sailing Ahead! Enjoy Express Delivery with Myntra Insider 🚀" Hey [User’s Name], We’re truly sorry to hear about your past delivery issues. We want to ensure a flawless shopping experience for you moving forward. Join Myntra Insider now and enjoy Express Delivery along with other exclusive perks! Get your favorite fashion pieces delivered at lightning speed. 🎁 Exclusive perks for Myntra Insiders: - Express Delivery 🚀 - Early access to sales 🛍️ - Personalized styling tips ✨ - Extra discounts and rewards 🎉 [Join Myntra Insider Button] Thank you for being a part of our community. We’re excited to make your next shopping experience better than ever! Warm regards, Team Myntra | Push notifications, Whatsapp | Incentive: Free trial of Myntra Insider with Express Delivery for the first month. Additional Perks: Exclusive discounts and early access to sales. | Frequency: One-time campaign with a follow-up reminder. Timing: Initial Email: Day 0 Follow-up Email: Day 5 | Sign-up rate for Myntra Insider. | Open Rate: Percentage of users who open the email. Engagement Rate: Click-through rate on the "Join Myntra Insider" button. Conversion Rate: Percentage of users who complete the sign-up for Myntra Insider. | Highlighting the benefits of faster and more reliable delivery can win back trust and improve the shopping experience, reducing friction. |

User who is getting better deals on other platforms | Attract users by offering best deals and competitive pricing. | Subject: "Get the Best Deal on Myntra or Get a Complete Refund! 🎉" Hey [User’s Name], We noticed you’ve been looking for better deals elsewhere. Guess what? We have unbeatable deals waiting just for you on Myntra! 🌟 Special Offers: - Up to 50% off on top brands - Additional 10% off with [Bank/Wallet Name] on orders above Rs. 1000 - Buy 1 Get 1 Free on select categories - And here's our promise: If you find a better deal on any item, we’ll match it or give you a full refund! [Shop Now Button] Don’t miss out on these amazing deals and our best price guarantee! Come back to Myntra and enjoy shopping without any worries. Happy shopping! Cheers, Team Myntra | Push notification, Social Media, WhatsApp | Incentive: Exclusive discounts, additional cashback with specific payment methods, limited-time BOGO (Buy One Get One) offers, and a price match guarantee or full refund. Additional Perks: Free shipping on first order after return, extended return window for loyal customers. | Frequency: One-time campaign with a follow-up reminder. Timing: Initial Email: Day 0 Follow-up Email: Day 3 | Increase in return user purchases within the campaign period. | Open Rate: Percentage of users who open the email. Engagement Rate: Click-through rate on the "Shop Now" button. Conversion Rate: Percentage of users who make a purchase. | Assurance of the best deals and a price match guarantee removes the financial risk, tempting users to return for competitive pricing. |

|

CREATIVE REFERENCES (E&R):

-- x -- x -- x -- x -- x -- x -- x -- x -- x -- x -- x -- x -- x -- x -- x -- x -- x -- x -- x -- x -- x -- x -- x -- x -

Thank You!

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.